-

Dear Guest, Please note that adult content is not permitted on this forum. We have had our Google ads disabled at times due to some posts that were found from some time ago. Please do not post adult content and if you see any already on the forum, please report the post so that we can deal with it. Adult content is allowed in the glory hole - you will have to request permission to access it. Thanks, scara

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Share Dealing

- Thread starter southstand1882

- Start date

Steed Train

Clive Wilson

Error

Last edited:

Steed Train

Clive Wilson

Investing in the markets is as risky as betting in a majority of circumstances. The best way to mitigate risk is to invest in a range of funds (managed by people that do it for a living) across asset sectors with different correlations.

How these sectors/classes are allocated depends what your own attitude to risk is, although someone with no investment experience should ever invest in a single share unless they are comfortable losing all the money. In addition you need to be comfortable not touching the money for about five years once invested in any equity based investment.

There's no such thing as free money. People like Warren Buffet poured over companies books for weeks to assess their potential for growth. If investment opportunities with huge growth potential were that easy to spot, most funds would have astronomical growth figures (they don't and they're run by top analysts)

How these sectors/classes are allocated depends what your own attitude to risk is, although someone with no investment experience should ever invest in a single share unless they are comfortable losing all the money. In addition you need to be comfortable not touching the money for about five years once invested in any equity based investment.

There's no such thing as free money. People like Warren Buffet poured over companies books for weeks to assess their potential for growth. If investment opportunities with huge growth potential were that easy to spot, most funds would have astronomical growth figures (they don't and they're run by top analysts)

southstand1882

Mitchell Thomas

Or you could just check my form and invest in CZA

Free money

Free money

southstand1882

Mitchell Thomas

Please tell me you invested in CZA?

They are up another 12% today!!!

They are up another 12% today!!!

Please tell me you invested in CZA?

They are up another 12% today!!!

Good news.. but will it last long as per the below

http://www.bloomberg.com/news/2013-...y-coal-declines-to-lowest-in-three-weeks.html

southstand1882

Mitchell Thomas

Good news.. but will it last long as per the below

http://www.bloomberg.com/news/2013-...y-coal-declines-to-lowest-in-three-weeks.html

The Chinese will keep CZA moving upwards for some while yet!

Coal will overtake oil in the next few years within BRIC

Remember CZA has already moved down.

southstand1882

Mitchell Thomas

CZA up again!

I've top sliced nearly £3k in profits since the 31st

Slightly surprised the MMs haven't tried shaking out a few short term traders; no doubt it will come before the EGM

2013 is the year of the junior mining stocks IMO. They have been massively oversold these last few years.

I've top sliced nearly £3k in profits since the 31st

Slightly surprised the MMs haven't tried shaking out a few short term traders; no doubt it will come before the EGM

2013 is the year of the junior mining stocks IMO. They have been massively oversold these last few years.

southstand1882

Mitchell Thomas

Good point actually, if a share is 12p and then goes to 24p it doesn't sound like much but you've actually doubled your money.

Its a 100% gain!

Try getting those rates at the bank! Lucky to get 2% on the high street

When I get a bit more spare cash I will be messaging you up. Better pay of the credit card first although its tempting to invest it make return and then pay of credit card quicker but it's a bit risky for me.

Whats your average return been money wise for each of say the last 5 years?

Whats your average return been money wise for each of say the last 5 years?

southstand1882

Mitchell Thomas

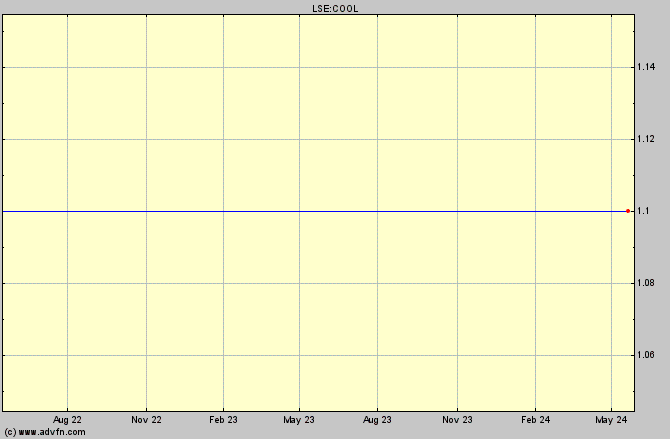

My next tip is COOL

10% gain today which was nice

10% gain today which was nice

Last edited:

CZA up again!

I've top sliced nearly £3k in profits since the 31st

Slightly surprised the MMs haven't tried shaking out a few short term traders; no doubt it will come before the EGM

2013 is the year of the junior mining stocks IMO. They have been massively oversold these last few years.

Are you actually putting real money in ? Or is this just a virtual portfolio as mentioned in your opening posts.

southstand1882

Mitchell Thomas

Are you actually putting real money in ? Or is this just a virtual portfolio as mentioned in your opening posts.

Yes, real money. Its an ISA I started in the summer, so its only low 5 figures.

southstand1882

Mitchell Thomas

COOL up massively in Australia

Fill your boots if you can purchase any at 8am

We should see >20% gains today IMO

Fill your boots if you can purchase any at 8am

We should see >20% gains today IMO

southstand1882

Mitchell Thomas

COOL up 30% at lunchtime

COOL up 30% at lunchtime

Fair dues.

Will this stick or come down for profit taking.??

Superhudd

Simon Davies

I'm sticking with RBS and Barclays on the back of this news.

For all of the above reasons they have revised their price target on Lloyds to 60p (from 50p) that for Barclays (LSE: BARC.L - news) to 315p (from 255p) and RBS (LSE: RBS.L - news) to 410p.

http://uk.finance.yahoo.com/news/broker-snap-ubs-hikes-targets-141100530.html

So I am going with a new target of Barclays 350p and RBS 400p (BARCs bought at 201.24p & RBS bought at 27.77p (that's now 277.77p) and 246.13p bought twice)

Ideally I want to be out of RBS as the government bought its shares at an average of 50p or £5.00 now. I cannot see them holding on and that high % they own will see the price drop IMO, unless they find a buyer willing to take the lot.

For all of the above reasons they have revised their price target on Lloyds to 60p (from 50p) that for Barclays (LSE: BARC.L - news) to 315p (from 255p) and RBS (LSE: RBS.L - news) to 410p.

http://uk.finance.yahoo.com/news/broker-snap-ubs-hikes-targets-141100530.html

So I am going with a new target of Barclays 350p and RBS 400p (BARCs bought at 201.24p & RBS bought at 27.77p (that's now 277.77p) and 246.13p bought twice)

Ideally I want to be out of RBS as the government bought its shares at an average of 50p or £5.00 now. I cannot see them holding on and that high % they own will see the price drop IMO, unless they find a buyer willing to take the lot.

southstand1882

Mitchell Thomas

CZA up 6.5% today

COOL up 32.5 today

£675 profit for the day, which I'll take!!

COOL up 32.5 today

£675 profit for the day, which I'll take!!