Leeds Spur

Banned

Clearly your time in the north has put you out of touch

A small 3 bed house in Windsor costs ?ú450,000.

Do the maths clever boy

I assume you've benefited from making money from nothing, hence your departed post.

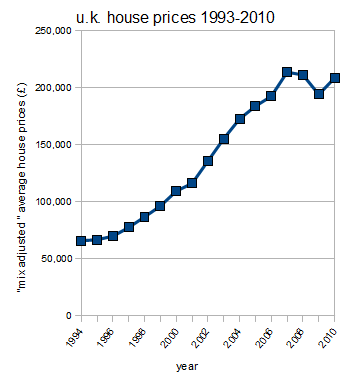

Oh and which part of the property bubble since 1997 do you not understand?

Pricisely why people in Windsor should pay the tax if their property is worth more thn ?ú2 million.

?ú450k is quite a bit less than ?ú2 million, so what's your point.

The unemployment in Leeds is less thena the national average and less than vast swaths of the south.

Basically if the mansion tax disproportionately affects the south, good!