spurs' magna carter

Naybet

Today I couldn't help but have a little look at the house prices in my old home town of Lewisham some five years after my parents moved to Sussex. The reason for me looking was a conversation I had with a photographer whilst working during the weekned, he informed me that he and his partner had bought a flat in Tower Hamlets after moving from Brighton, they looked at 20 different properties all around the capital and were stunned by how over flated egos were once again over inflating the market with prices that were beyond unfathomable, said that the average increase is 30% per year.

During my search I came across this http://www.rightmove.co.uk/property-for-sale/property-31809627.html

At pre-market crash levels that house would've cost around £500k, infact what's more astonishing is that it costs what it does now whilst looking like Vyvyan and Rick had just vacated it, okay not that bad but nothing to get a bona over. But because it's in the middle of a town being gentrified and having those 3 famous estate agent words 'great transport links' it has to have a high price (and great commission). Whilst telling my father this he said that he had donethe same thing himself recently and spotted one house a few doors down from that one with difference between the two being a single storey side extension at a staggering £1m.

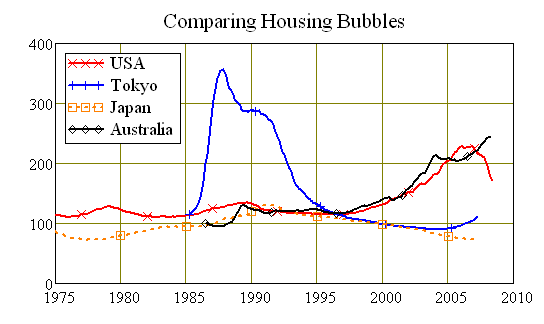

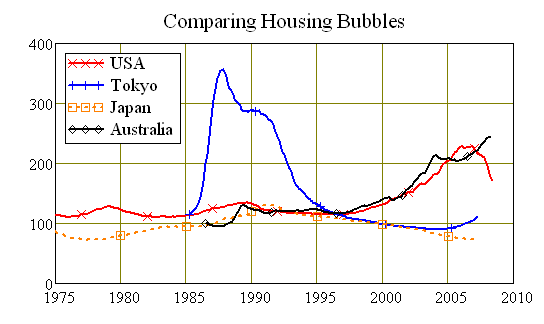

Now, seeing as our economy pretty much relies upon the housing market to double every other year and is just recovering from the worst set back in decades whilst also being centralised to London it begs the question, what would happen if the Bubble burst again? Also, is this sillyness ever gonna stop?

One point to make is Tokyo, even before the crash Japan's economy was only just recoving from the Tokyo housing market crash of the late 80s and fear LDN could be going the same way.

During my search I came across this http://www.rightmove.co.uk/property-for-sale/property-31809627.html

At pre-market crash levels that house would've cost around £500k, infact what's more astonishing is that it costs what it does now whilst looking like Vyvyan and Rick had just vacated it, okay not that bad but nothing to get a bona over. But because it's in the middle of a town being gentrified and having those 3 famous estate agent words 'great transport links' it has to have a high price (and great commission). Whilst telling my father this he said that he had donethe same thing himself recently and spotted one house a few doors down from that one with difference between the two being a single storey side extension at a staggering £1m.

Now, seeing as our economy pretty much relies upon the housing market to double every other year and is just recovering from the worst set back in decades whilst also being centralised to London it begs the question, what would happen if the Bubble burst again? Also, is this sillyness ever gonna stop?

One point to make is Tokyo, even before the crash Japan's economy was only just recoving from the Tokyo housing market crash of the late 80s and fear LDN could be going the same way.

Last edited: