Modric THFC

Jimmy McCormick

Huge issue at the moment. The Guardian are running a serious of articles this week on it.

First this exclusive

http://www.theguardian.com/football/2014/sep/23/uefa-third-party-ownership-champions-league

Uefa plans rule change to clamp down on third-party player ownership

Uefa is poised to introduce new rules to tackle urgently what it sees as the scourge of third-party ownership of players in Europe as early as next season. Transgressors ultimately face the possibility of transfer bans or having players excluded from the Champions League.

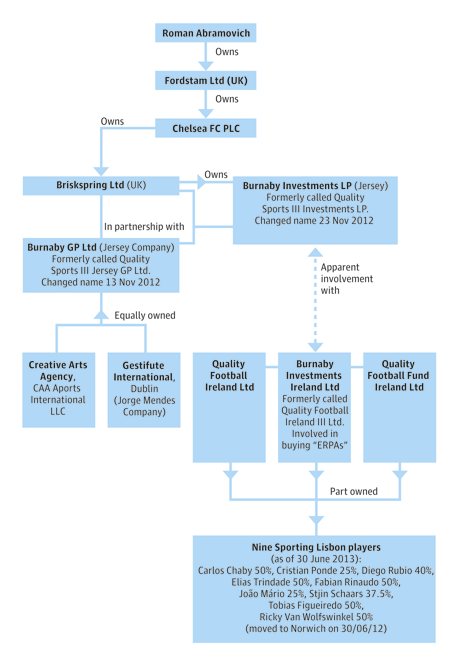

A Guardian investigation on Monday revealed that Jorge Mendes, regarded as the most powerful football agent in Europe, is serially involved in third-party ownership and Uefa, increasingly frustrated by Fifa’s inaction on the issue despite repeated vows to tackle the problem, is now drawing up new rules that could be introduced for its next three-year cycle of competition from 2015-16.

As with the introduction of its financial fair play, there would be a transition period to allow clubs to comply with the new rules but the aim would be to clamp down on third-party ownership among clubs competing in the Champions League or Europa League.

A study for KPMG last year put the overall value of players owned under TPO schemes, where third parties invest in up to 50% of a player or loan the equivalent value, at €1.1bn.

In Portugal, Spain and Eastern Europe where the practice has proliferated since it was imported from South America in the last decade, large numbers of players are now owned in part by third parties.

A new joint study commissioned by Fifa from the Centre de Droit et d’Economie du Sport and the Centre International d’Etude du Sport, which has been seen by the Guardian, has warned of mushrooming integrity concerns.

Supporters of TPO insist it allows clubs to buy players they would not otherwise be able to afford but the study says that, on the contrary, it locks them in a “cycle of debt and dependence”. It also raises a string of integrity concerns stemming from a lack of transparency among those investing in the funds and the possibility of them exerting pressure on players, coaches and club owners. Even more seriously, the practice has been linked to match-fixing.

The Fifa president, Sepp Blatter, first vowed to take action on third party ownership in 2007, shortly after the Premier League had banned it in the wake of the Carlos Tevez affair.

A Fifa spokeswoman said it had been “challenging” to get a true picture of the scale and scope of third party ownership and that a new working group led by the former FA chairman Geoff Thompson was continuing to assess the problem.

It has said its executive committee would decide on the next steps and remains “fully committed to reaching a solution that best protects football”. But the issue is not even on the agenda at this week’s Fifa executive committee meeting and the widespread use of TPO in Brazil and Argentina makes it difficult to act at a global level.

Now, the Uefa general secretary, Gianni Infantino, has told the Guardian that if Fifa fails to act then Uefa will take its own steps.

“It threatens the integrity of sporting competition, it damages contractual stability, it undermines the relationship of trust that should exist between a player and the club that employs him, it creates conflicts of interests, it means that players have less control over the development of their own careers, it keeps clubs in a vicious cycle of debt and dependence and damages the overall image of football,” he said.

“Furthermore, there is little doubt that third-party investors do influence the transfer policies of clubs even though Fifa rules expressly forbid this. These are actually the findings of Fifa’s own – detailed – research into this subject. So, it’s now time to act, and if Fifa does not address the problem, then Uefa will.”

The practicalities of any new rules are still being worked through by Uefa’s lawyers but one option would be to set up a new body to assess the ownership of players, alongside its existing disciplinary committee and Financial Control Body (which assesses FFP).

Clubs would be required to prove that their players were wholly owned and could ultimately be subject to transfer bans or face having to leave players partially owned by third parties out of their European squads.

The hope, as with its controversial FFP rules, is that over time the regulations will influence the behaviour of clubs where TPO is rife. It would hit clubs in Portugal, Spain and some parts of Eastern Europe hard but Uefa is determined to act.

As well as England, third-party ownership is banned in France and Poland. Four major deals by Premier League clubs this summer, including Emirates Marketing Project’s £32m capture of Eliaquim Mangala from Porto, involved third-party shares being bought out.

“Premier League rules prohibit Third Party Ownership as we believe that it threatens the integrity of competitions, reduces the flow of transfer revenue contained within the game, and has the potential to exert external influences on players’ transfer decisions,” said a Premier League spokesman.

First this exclusive

http://www.theguardian.com/football/2014/sep/23/uefa-third-party-ownership-champions-league

Uefa plans rule change to clamp down on third-party player ownership

Uefa is poised to introduce new rules to tackle urgently what it sees as the scourge of third-party ownership of players in Europe as early as next season. Transgressors ultimately face the possibility of transfer bans or having players excluded from the Champions League.

A Guardian investigation on Monday revealed that Jorge Mendes, regarded as the most powerful football agent in Europe, is serially involved in third-party ownership and Uefa, increasingly frustrated by Fifa’s inaction on the issue despite repeated vows to tackle the problem, is now drawing up new rules that could be introduced for its next three-year cycle of competition from 2015-16.

As with the introduction of its financial fair play, there would be a transition period to allow clubs to comply with the new rules but the aim would be to clamp down on third-party ownership among clubs competing in the Champions League or Europa League.

A study for KPMG last year put the overall value of players owned under TPO schemes, where third parties invest in up to 50% of a player or loan the equivalent value, at €1.1bn.

In Portugal, Spain and Eastern Europe where the practice has proliferated since it was imported from South America in the last decade, large numbers of players are now owned in part by third parties.

A new joint study commissioned by Fifa from the Centre de Droit et d’Economie du Sport and the Centre International d’Etude du Sport, which has been seen by the Guardian, has warned of mushrooming integrity concerns.

Supporters of TPO insist it allows clubs to buy players they would not otherwise be able to afford but the study says that, on the contrary, it locks them in a “cycle of debt and dependence”. It also raises a string of integrity concerns stemming from a lack of transparency among those investing in the funds and the possibility of them exerting pressure on players, coaches and club owners. Even more seriously, the practice has been linked to match-fixing.

The Fifa president, Sepp Blatter, first vowed to take action on third party ownership in 2007, shortly after the Premier League had banned it in the wake of the Carlos Tevez affair.

A Fifa spokeswoman said it had been “challenging” to get a true picture of the scale and scope of third party ownership and that a new working group led by the former FA chairman Geoff Thompson was continuing to assess the problem.

It has said its executive committee would decide on the next steps and remains “fully committed to reaching a solution that best protects football”. But the issue is not even on the agenda at this week’s Fifa executive committee meeting and the widespread use of TPO in Brazil and Argentina makes it difficult to act at a global level.

Now, the Uefa general secretary, Gianni Infantino, has told the Guardian that if Fifa fails to act then Uefa will take its own steps.

“It threatens the integrity of sporting competition, it damages contractual stability, it undermines the relationship of trust that should exist between a player and the club that employs him, it creates conflicts of interests, it means that players have less control over the development of their own careers, it keeps clubs in a vicious cycle of debt and dependence and damages the overall image of football,” he said.

“Furthermore, there is little doubt that third-party investors do influence the transfer policies of clubs even though Fifa rules expressly forbid this. These are actually the findings of Fifa’s own – detailed – research into this subject. So, it’s now time to act, and if Fifa does not address the problem, then Uefa will.”

The practicalities of any new rules are still being worked through by Uefa’s lawyers but one option would be to set up a new body to assess the ownership of players, alongside its existing disciplinary committee and Financial Control Body (which assesses FFP).

Clubs would be required to prove that their players were wholly owned and could ultimately be subject to transfer bans or face having to leave players partially owned by third parties out of their European squads.

The hope, as with its controversial FFP rules, is that over time the regulations will influence the behaviour of clubs where TPO is rife. It would hit clubs in Portugal, Spain and some parts of Eastern Europe hard but Uefa is determined to act.

As well as England, third-party ownership is banned in France and Poland. Four major deals by Premier League clubs this summer, including Emirates Marketing Project’s £32m capture of Eliaquim Mangala from Porto, involved third-party shares being bought out.

“Premier League rules prohibit Third Party Ownership as we believe that it threatens the integrity of competitions, reduces the flow of transfer revenue contained within the game, and has the potential to exert external influences on players’ transfer decisions,” said a Premier League spokesman.